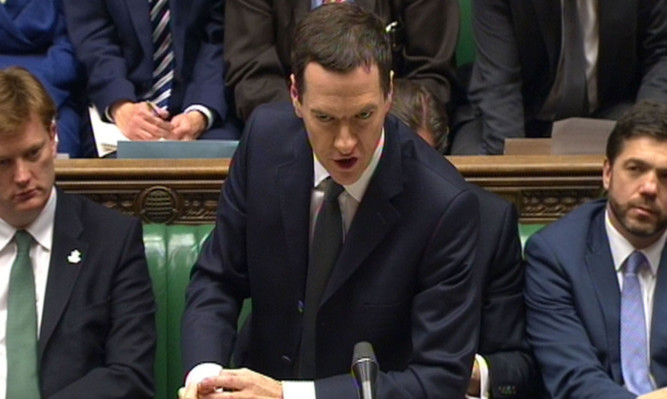

The grim reality of Chancellor’s hike in pensions.

Hundreds of thousands of OAPs will see their pension increase by as little as 60p a week next year.

On Thursday it was announced in a blaze of publicity that the basic state pension would rise by 2.5% in April the equivalent of £2.85 more a week for a single person.

But it’s emerged the move is partly being paid for by cuts announced in the Chancellor’s Autumn Statement to the “Savings Credit” pension.

This is a top-up scheme paid to those with a modest income who saved for retirement.

Around one million recipients of this weekly payment will see it cut by up to £1.98 in April, leaving them with a net rise in their state pension income of just 87p.

A further 600,000 pensioners who are married or live as a couple will fare even worse, facing an increase of just 60p depending on their circumstances.

The changes mean the very poorest pensioners will get the full £2.85 weekly hike but those with just a bit more income, who have worked hard all their lives but are potentially still struggling financially, will miss out.

Those who are better off and not in receipt of the top-ups will also get the full £2.85 increase in their total state pension income.

SNP MSP Sandra White, Convener of the Scottish Parliament’s Cross-Party Group on older people, said: “This is the latest example of George Osborne’s sustained attack on the poor, and this time it is poorer pensioners who are in his sights.

“This cut will hit poorer pensioners who have planned ahead and worked hard for their retirement.”

The 87p rise applies to anyone in receipt of the full basic state pension and a weekly fixed income, before any Pension Credits, of between £10.55 and £72.30.

Savings Credit, introduced as a reward for those who put money away for retirement, is a maximum of £16.80 a week this year but from April that will be cut to £14.82.

The payment has been cut by 28% since 2010, while the basic state pension has increased by 19% over the same period.

Ministers have ruled Savings Credit will not be paid to anyone who reaches state pension age from 2016 and have excluded the measure from the “triple lock” guarantee of increases in line with earnings, prices or at least 2.5%, which only applies to the basic state pension.

The Department for Work and Pensions said: “To protect the poorest pensioners, the Government has taken the decision to raise the standard minimum guarantee for Pension Credit in line with the cash rise in the basic state pension.

“The cost is being offset by an increase in the Savings Credit threshold. In the current economic climate the Government believes it is right to target resources to protect the income of our poorest pensioners.”

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe