35 is the age where most Brits will reach their financial ‘crunch point’, according to new research.

The study, for MoneySuperMarket, revealed the peak age at which most are likely to be juggling the cost of young children with mortgages and loan repayments for cars, holidays and weddings.

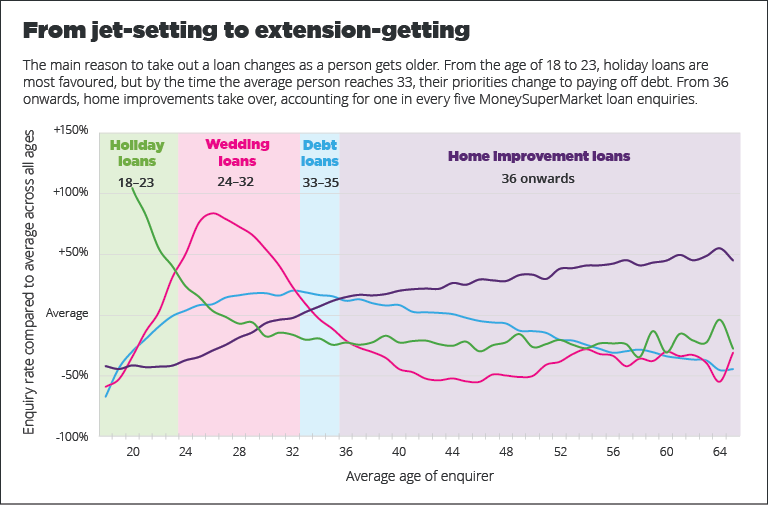

Their report charts the average lifetime of borrowing, using analysis of 2.7 million credit card and loan enquires on its eligibility tool to build a unique picture of the nation’s key borrowing milestones.

The report reveals that the average British borrower will owe £309,000 over their lifetime, including £111,000 in interest, should they buy a house at the average price, get a student loan, live with credit card for a decade and take out personal loans for a new car and a holiday abroad.

The timeline plots the ‘financial rites of passage’ that Brits will transition through during adulthood:

23: With university fees nearly trebling to £9,000 in 2012, it’s not surprising that borrowing starts at just 23 years old – the average age for students to enquire about a credit card as they embark on their post-university career

28: The late twenties represents a major borrowing peak – as financial responsibilities start to kick in but Brits are two years away from hitting the national salary average (£28,200), this age sees the highest rate of enquiries for credit cards and loans

32: The peak age for having a baby is now 32 years old and has been steadily increasing over the last fifty years. The delay may also mean prospective parents feel better prepared financially to cope with the £230,000 cost of raising a child to 21.

35: With a mortgage, children and previous outstanding loans, 35 years old is when Brits most feel the financial squeeze, with the number of applications for ‘debt loans’ – loans specifically to pay off other debts – soaring at this age

39: With rocketing housing prices and the introduction of new stamp duty tariffs, families are increasingly opting to stay put and extend as opposed to trading up, with home improvement loans peaking at the age of 39

44: The most common age for divorce is now a relatively young 44 years old, costing the average divorcee a huge £70,000 – nine times higher than the average wedding loan

65: While this age sees the lowest rate of enquiries for loans and credit cards, the amount requested is at its highest, revealing that borrowing continues well into retirement age

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe