THE Government is coming under pressure not to “duck and dive” over the pay and jobs of workers caught up in the collapse of construction giant Carillion amid mounting fears of redundancies.

Theresa May’s Cabinet was meeting on Tuesday as the fallout from the crisis continued to reverberate through the Government.

Top executives face investigation after the firm’s demise put thousands of jobs at risk and saw the Government heavily criticised for its role in the debacle.

Labour leader Jeremy Corbyn said Carillion’s collapse was a “watershed moment” that should bring an end to “rip-off privatisation” of public services.

The leader of the Rail, Maritime and Transport union is pressing Transport Secretary Chris Grayling and other ministers to clarify who qualifies as a public sector worker after an announcement that firms working for Carillion on purely private sector deals will only have two days of Government support.

RMT general secretary Mick Cash said: “We have been told this morning that only Carillion workers on what the Government defines as ‘public sector’ contracts will be guaranteed their wages.

“Clearly, anyone working in the rail sector is providing a service to the public and we are calling on the Government to confirm this morning that there will be no dispute over this point and that our members will continue to be paid with their functions taken directly in house.

“There should be no equivocation from the Government and no attempt to duck and dive around this issue. The Government have known for months that Carillion was in trouble and they should have had plans well in hand for just this situation.

“All of the Carillion rail works on the various contracts can be brought in house easily and that is what we expect to happen with jobs and services protected. If there’s limitless amounts of cash to bail out rail franchises like Southern and East Coast there should be no penny pinching when it comes to workers caught in the crossfire of the Carillion collapse.”

Engineering services bodies ECA and the BESA told Business Secretary Greg Clark in a meeting on Monday evening that the loss of hundreds of millions of pounds owed by Carillion is likely to damage many specialist suppliers, and put others out of business.

The BESA and ECA urged the Government to ensure that firms affected by the collapse of Carillion receive maximum Government and banking support.

The Government has been heavily criticised for its role in the collapse of Carillion.

But after attending a meeting of the Government’s emergency planning committee Cobra on Monday night, Cabinet Office minister David Lidington said efforts to deal with the crisis had “gone pretty well”.

He said: “The message today was that day one had gone pretty well, people were turning up to work, we had not had reports of any serious disruption to service delivery.

“But we also had a report from PwC, who are working as the special managers for the Official Receiver, that took us through the advice they are providing to concerned employees and contractors on their website and through their helpline.

“And it was an opportunity for ministers just to test what is going on, what sort of concerns are being expressed and to decide how we should best address those and provide the reassurance people want.”

A last-ditch plea from Carillion to the Government to provide it with a £20 million lifeline fell on deaf ears over the weekend, triggering a compulsory liquidation to be overseen by PwC.

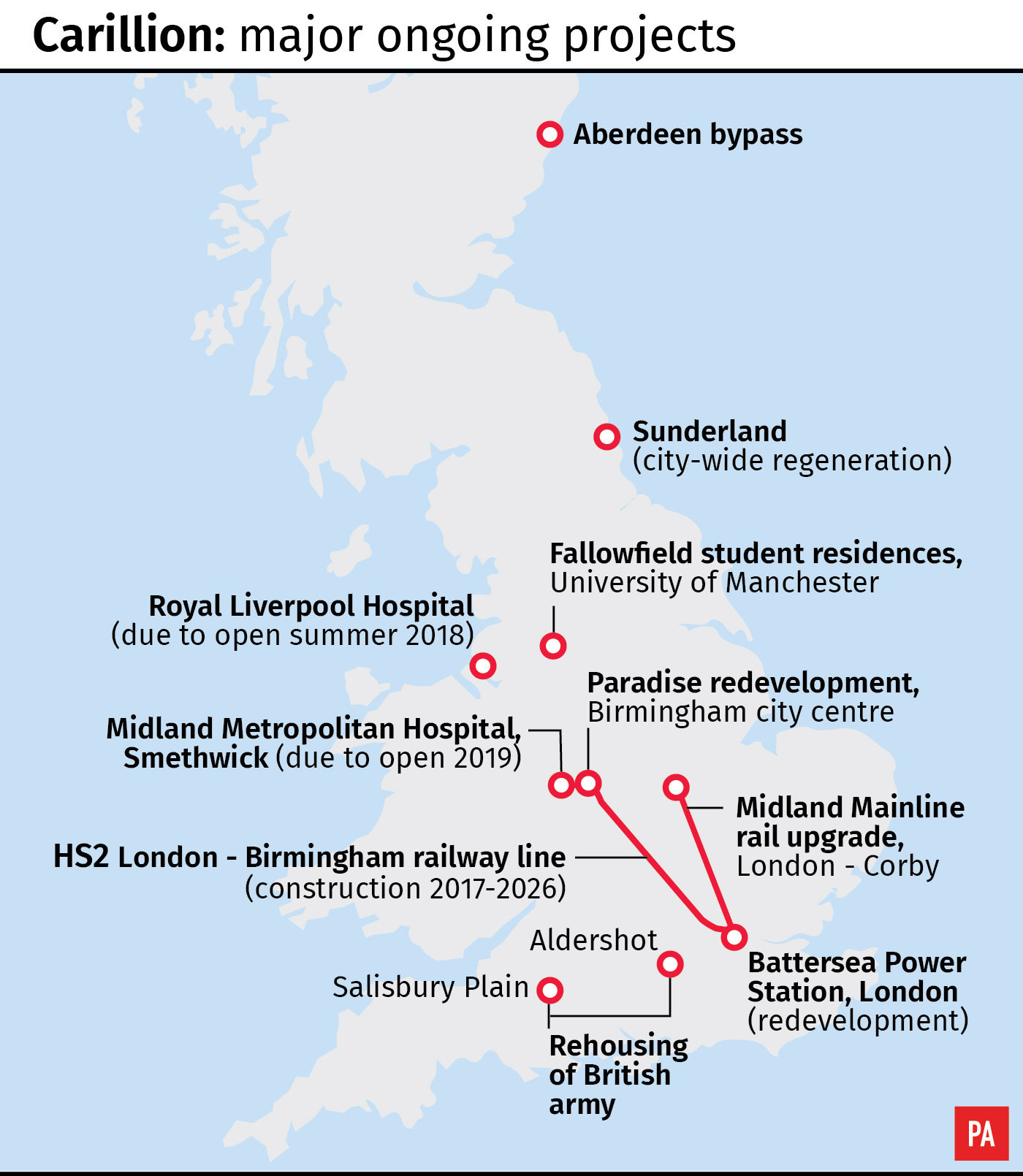

Carillion has public sector or public/private partnership contracts worth £1.7 billion, including providing school dinners, cleaning and catering at NHS hospitals, construction work on rail projects such as HS2 and maintaining 50,000 army base homes for the Ministry of Defence.

But it has seen its shares price plunge more than 70% in the past six months after issuing a string of profit warnings and breaching its financial rules.

The group, which employs around 20,000 British workers, has been struggling under £900 million of debt and a £587 million pension deficit.

Mr Lidington told Parliament on Monday afternoon that the Official Receiver would investigate the role of the company’s former and current directors, warning they could face “severe penalties”.

He spoke amid growing anger at bumper payouts received by former chief executive Richard Howson.

He pocketed £1.5 million in salary, bonuses and pension payments during 2016 and, as part of his departure deal, Carillion agreed to keep paying him a £660,000 salary and £28,000 in benefits until October.

Liberal Democrat leader Sir Vince Cable said this was a “reward for failure that has to be looked into”.

Theresa May’s official spokesman said that, initially, the Government will be paying staff through the Official Receiver to ensure that public services continue to run as normal.

He added that there would be some additional burden on the taxpayer from the cost of the receiver.

But Mr Lidington insisted that Carillion’s failure will see “shareholders and lenders bear the brunt” of the pain, rather than taxpayers.

Shareholders will be wiped out and lenders including HSBC, Barclays, Santander and Royal Bank of Scotland are reportedly set to lose an estimated £2 billion as a result of the collapse.

The group’s demise has posed questions as to why Carillion continued to receive Government contracts despite issuing a number of profit warnings.

Asked whether it had been a mistake to continue awarding contracts to Carillion, the PM’s spokesman said: “Since July, we have kept a very close eye on this, but of course if there are lessons which can be learned, they will be.”

Steve Webb, the former pensions minister, also questioned why the company had increased its dividend payments when it was grappling with a hefty pension deficit.

In a tweet, he wrote: “2016 Carillion annual report says dividend ‘has increased in each of 16 years since formation of company’; Is this really acceptable alongside a pension fund deficit over half a billion pounds?”

Carillion retirees already receiving their pensions will continue to receive payments, the Government has said.

However, there are around 27,000 staff involved in its defined benefit schemes which are likely to be transferred to the Pension Protection Fund (PPF).

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe