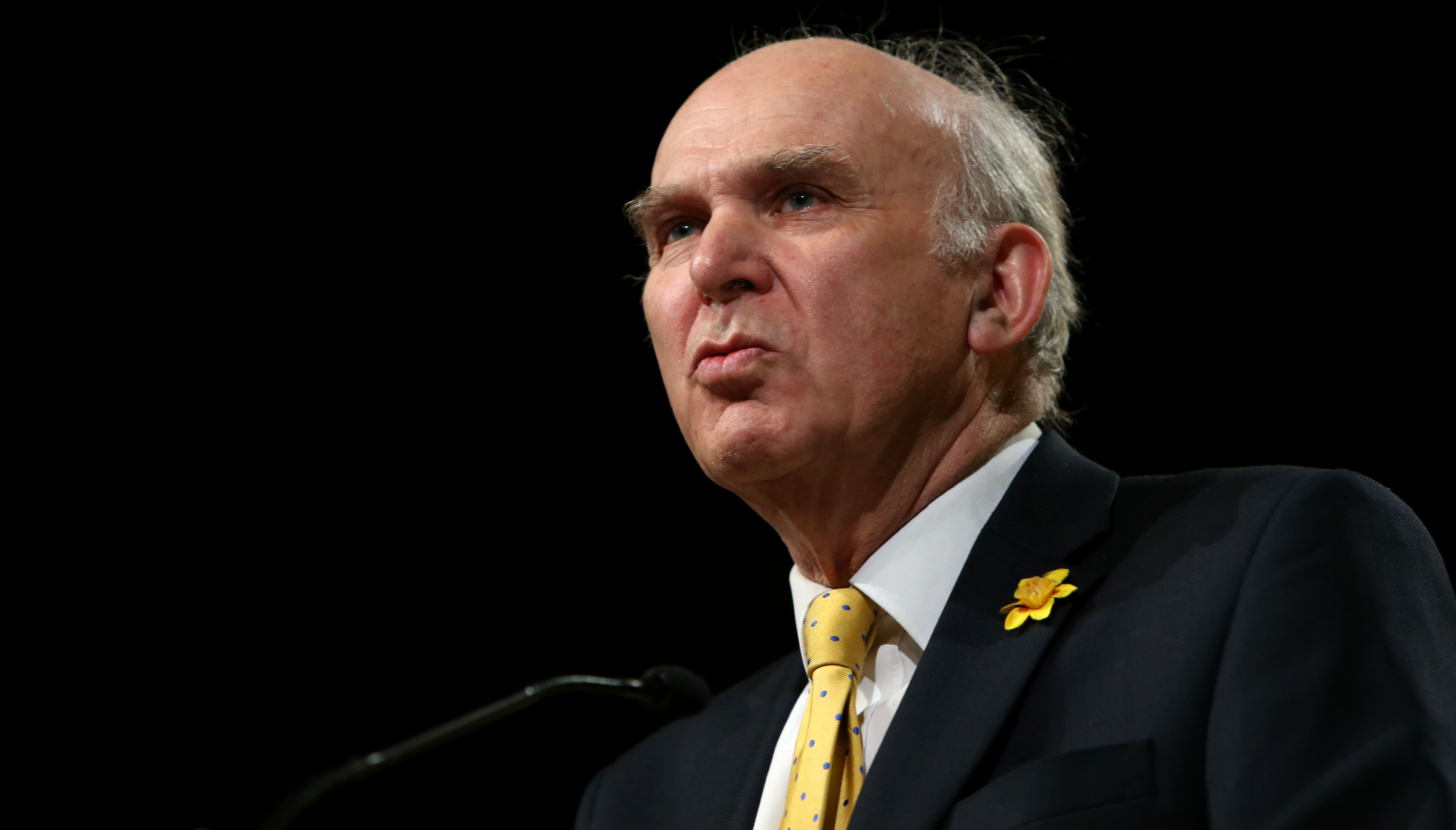

SIR Vince Cable has warned the UK is on the verge of another credit crunch because the banks have “forgotten the lessons of the past”.

The Lib Dem leader, who was one of the first politicians to warn of the 2007 financial crash, claimed “complacency is setting in” a decade on, with banks allowing unsustainable levels of consumer credit to build.

The former Business Secretary said he was still angry bankers had been let off the hook for the crash because of the “cultural” closeness between his former Conservative coalition partners and the financial sector.

Sir Vince claimed the Tories were “not eager” to clamp down on individuals such as former RBS chief Fred Goodwin, resulting in “a lot of political cynicism”.

Last month Bank of England Governor Mark Carney warned financial chiefs to ensure that consumer lending, including credit cards and loans, was in check amid fears that an unsustainable credit bubble was building.

Sir Vince said: “The British economy is heavily dependent on consumer debt.

“The worry is not that the banks will crash but more that quite a lot of people who have borrowed will not be able to sustain their payments if the economic conditions change.

“The banks have primary responsibility for this and I do sense some of them have forgotten the lessons of the past. On the positive side, what has happened since 2008 is the banks are a lot safer, holding more capital and the big reform to split the so-called casino parts from the retail banks has been put through.

“The more worrying thing is that, a decade after the crisis, a certain amount of complacency is setting in with the industry itself pouring in a large amount of consumer credit, such as car purchase loans.

“It’s not sustainable and there could be another credit bubble which could end nastily.”

There has been widespread public frustration at the lack of prosecutions related to the financial crisis, though in June it was revealed three former bankers at Barclays would face charges of fraud.

Sir Vince said: “I’m disappointed that a lot of the people who were personally responsible for the excesses of the banking system have not been held to account; Fred Goodwin is just one example. Until the recent Barclays case, most of the people involved had walked away.”

Sir Vince, Business Secretary between 2010 and 2015, said his Tory counterparts were “not eager” to hold bankers responsible for the crisis.

He explained: “We wanted to see more radical action than they were comfortable with. The Tories were much closer to the banking industry than we were, much more likely to apologise for it.

“They tried to shift all the responsibility on to budget deficit rather than acknowledge the underlying problem was the banking crisis. It has induced quite a lot of political cynicism.

“Ten years after the crisis, living standards are no higher than they were before and there is the sense that the people who caused the problem have walked away and that has fed a sense of disillusionment.”

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe