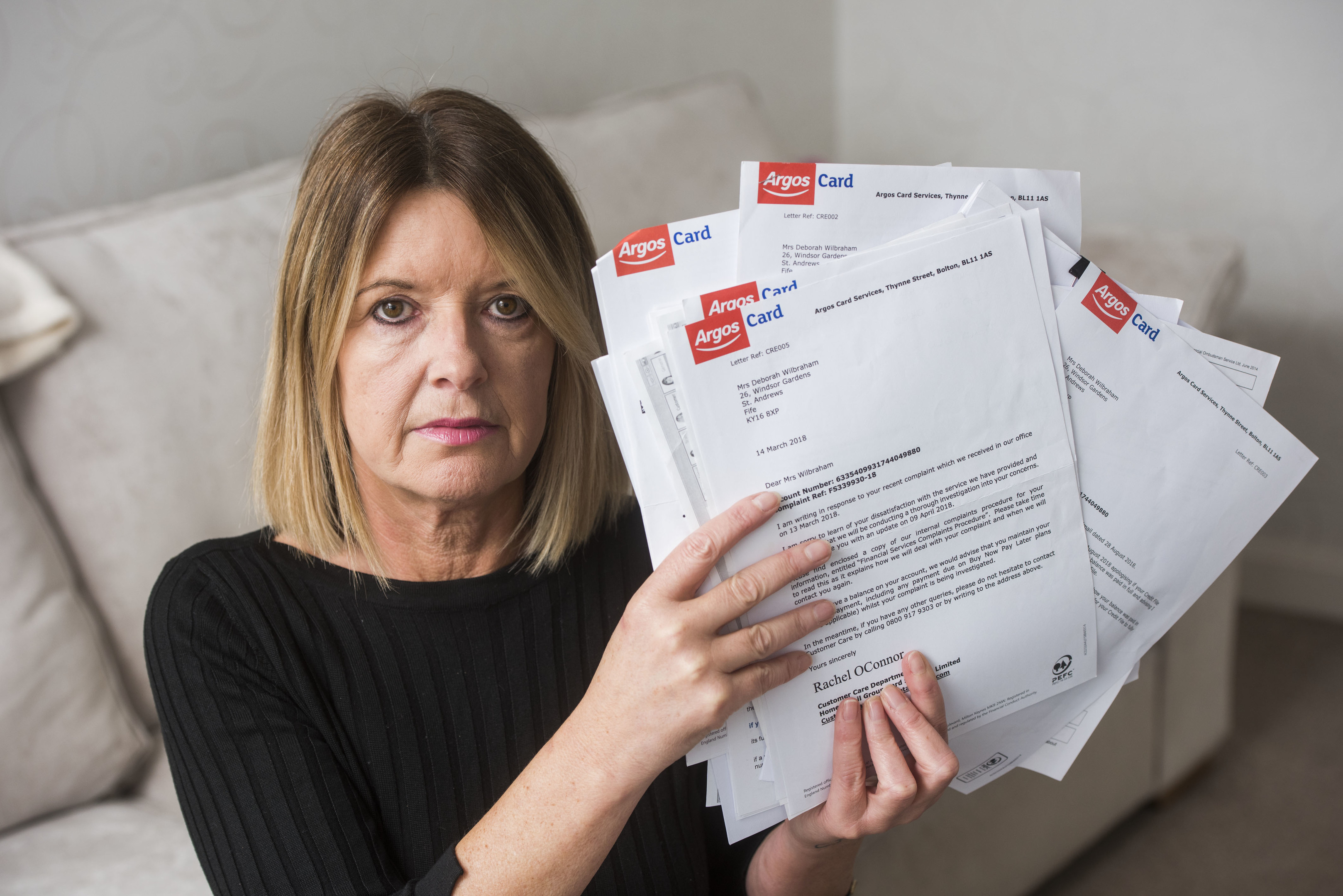

DEBBIE Wilbraham has had her credit score wrecked by a minor mistake – now she wants to warn others about the “nightmare” consequences.

A £29.99 purchase made on her Argos store card 12 months ago has ended up costing the education administrator from St Andrews at least £6,000.

“I can’t believe something so minor has had such a major impact on my life,” said Debbie, 52.

“It has been a nightmare.”

In February, Debbie was told that £69 was outstanding on her Argos account, relating to a £29.99 purchase made five months previously, plus late payment fees and interest.

Debbie questioned the figure, reminding the catalogue retailer she had been making regular monthly payments, which she was able to prove through her bank statements.

However, the previous summer, Debbie had transferred £50 to a friend’s Argos account as a favour.

It transpired that all Debbie’s payments thereafter had been credited to her pal’s Argos account rather than her own.

The firm accepted that Debbie’s subsequent payments, starting with the £29.99, had gone into the wrong account, and eventually refunded her £169.

However, unbeknown to Debbie, by this time a default had been recorded on her credit report. “While all this was going on I was in the middle of a mortgage application,” she said.

“I had been accepted in principle but the broker pulled out when I failed a credit check.”

Debbie eventually did secure a mortgage – but had to pay a whopping 8% interest rate because her credit rating had been damaged.

She has so far spent about £6,000 cancelling her original mortgage application and arranging a new deal.

Debbie also knows her new high-interest-rate repayments will cost her “many thousands of pounds” more than a regular deal would have in the years to come.

Argos insisted it followed the correct procedures. And when Debbie contacted the Financial Ombudsman, her complaint was not upheld.

Following the decision, Argos wrote to Debbie’s solicitor last month stating they had “nothing further to add.”

A spokesperson for Argos Financial Services told Raw Deal that Debbie should have contacted the company sooner, adding that it was important customers responded to correspondence “so that they can challenge any issues in a timely manner”.

To improve your credit score:

Keep credit card balances low

Avoid opening lots of new accounts in a short space of time

Keep some accounts for a long period of time

Register on the electoral roll

Don’t miss any payments

Always stay within agreed borrowing limits

How can I be blacklisted when all my payments were up to date?

Gail Reid has been through a similar ordeal.

She had her mobile phone disconnected by Vodafone last October after it claimed she owed £247.

In March, the mum-of-two’s service was reconnected after she proved her payments were up to date via an agreed repayment plan.

Not long after that, Gail, from Paisley, was shocked when she applied for a credit card and was turned down.

It was then she discovered that late payment markers had been put on her credit file.

Appeals to Vodafone to have the markers removed have been unsuccessful.

Gail has now complained to the Ombudsman. “I have been ‘blacklisted’ for credit when I wasn’t informed by Vodafone that a marker would be placed on my credit file if I took out their repayment plan. This has been hugely stressful.”

A spokesperson for Vodafone said: “Although Mrs Reid did ultimately pay the arrears, this was only completed through a payment plan which meant the balance was carried over each month, resulting in late payment markers.

“Now that the balance is clear we have offered to change these to arrangement markers.

“However, we cannot remove them entirely.

“In view of misadvice she was given by an adviser, we also offered a goodwill payment of £25 by way of apology. Mrs Reid has declined these offers and has already referred the case to the Ombudsman for an impartial review.”

Factors which could hinder your rating:

Late or missed payments

Not being on the electoral roll

Borrowing right up to the limit on credit cards

Applying for lots of credit in a short space of time

Defaulting an account

Having a court judgment made against you or becoming insolvent

Very high levels of borrowing

Advice

Your credit report contains information about your financial transactions over a six-year period.

It gauges how well you manage your credit cards, bank accounts, mobile phone contracts and even utilities.

Lenders will use the information on your report, along with your application form details and any records they may already have, to generate your credit score.

This helps them decide whether to offer customers credit.

As a general rule, the higher your score the better.

A good track record of paying back debt should improve your chances of being accepted for new credit at the best rates.

If you find yourself in a similar situation to Debbie or Gail, Experian consumer affairs executive John Webb offers the following advice.

Dispute incorrect information with the lender, or by using a credit reference agency to act on your behalf.

Add a Notice of Correction – up to 200 words – to explain any negative information, such as defaults or late payments.

Lenders can factor these reasons into the decision-making process. But it could slow down the application process in the future.

When applying for credit, especially with negative information, consider using a comparison service to check your eligibility.

It doesn’t impact your credit score but will show the deals you may be accepted for.

It’s a good idea to check your credit report from time to time, especially before you apply for credit.

You can do this for free with any of the three main credit reference agencies – Experian, Equifax and TransUnion.

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe