A money-lending firm linked to Michelle Mone’s husband is imposing repayment rates of up to 92%.

Business is booming for Monthly Advance Loans (MAL), part of a nest of firms linked to Doug Barrowman as experts say the cost of living crisis is driving more people to take out short-term, high interest loans.

Figures suggest the number of Scots in debt has trebled in a year and advisers say more are being tempted to take out fast, unsecured loans like those offered by Bournemouth-based MAL, where annual percentage rates (APR) range from 24% to 92%.

Records show Barrowman, who along with his wife is under police investigation over £200m of PPE (personal protection equipment) contracts given to PPE Medpro, a firm linked to the couple, is an investor in the firm’s parent company Mal (Holdings) Ltd. It is registered at the Isle of Man headquarters of his offshore Knox Group business empire. The office is also the address of Barrowman and Mone’s charity, the Barrowman Foundation, set up for the “relief of poverty”.

Set up in 2019, MAL’s board of directors includes Barrowman’s accountant son Andrew, 31, and Knox executive Ed Ogden.

The latest accounts for 2021 show it is now owed £1.93 million, up from £69,000 in a year. Meanwhile, it has £169,000 in the bank compared with £7,000 in 2020.

Its books also suggest it is being bankrolled by investors, who lent the company £2.47 million in 2021, but are not named. The Barrowman Foundation was set up in 2017 with the stated aim of improving “conditions of life in socially and economically disadvantaged communities” by “providing grants…to individuals or charities” and has made donations of £1.97 million.

The three trustees are Barrowman, Mone and Arthur Lancaster – formerly a business associate of Prince Andrew and director of MAL.

Recipients of cash from the Foundation have included the Prince’s Trust – set up by King Charles when he was the Prince of Wales – which, in 2019, named a young people’s centre in Manchester after Barrowman. Along with the Royal Marsden Cancer Charity and ActionAid – which received £273,000 for education projects in Ghana – it has now distanced itself from the Foundation.

Barrowman has written off a £1.46 million loan which was used by the charity to make donations.

Between May 2020 and November 2021, the Foundation, MAL and PPE Medpro shared the same address at 16 High Holborn in London.

The debt charity StepChange dealt with 10,520 new UK clients last December, up 10% from 9,566 in December 2021.

However, among them, the numbers whose problems are due to the rising cost of living trebled to 2,314.

Around half of those seeking help owe money to a loan company, with the average debt £12,730.

Sharon Bell, head of StepChange Scotland, the Scottish arm of the charity, said: “People turning to credit with sky-high APRs are often doing so due to a lack of other options, and very often to make ends meet.

“At a time when people are struggling to cover the everyday essentials of food and household bills, further borrowing, particularly high-cost credit, is likely to only exacerbate problems.”

Citizens Advice Scotland’s financial health spokesman Myles Fitt added: “High APRs are only going to end in tears for the borrower.

“Lenders need to play fair. It’s one thing to seek a profit for offering a service, but they have a responsibility to make sure the borrower will be able to repay it.”

Marketed as “loans by mal” and with a cute duck logo, customers of the firm linked to Mone’s husband can borrow between £1,000 and £5,000 with a repayment period of up to two years.

Interest rates vary from 12.5% to 40.9%, but when fees are added, the firm suggests “the maximum APR you could be offered is 92%”, which is around four times the rate of a credit card and up to 15 times that charged by a bank.

MAL’s small print warns borrowers with a poor financial record may face larger repayments. It states: “We will offer a rate based on our assessment of your personal financial circumstances including your credit score.”

Scottish Labour finance spokesperson Daniel Johnson voiced concern that short-term loan firms are making profits from those most desperately in need. He added: “Exploiting people’s financial misery is completely unacceptable.”

SNP MSP Bob Doris said some progress had been made in regulating money lenders, but added: “It remains wholly unethical for debt-lending companies to target those in financial distress, charging exorbitantly high rates.

“The first port of call for those struggling should be good-quality financial advice from a reputable agency.

“It may be time to look once more at how this sector is regulated.”

MSP Katy Clark, who has been campaigning for a debt amnesty, added: “We have a personal debt crisis. Household debt as a percentage of disposable income is at the highest rate in a decade, and millions of Scots are taking out some form of borrowing to pay for household essentials.

“High-cost loans are leaving families in poverty.”

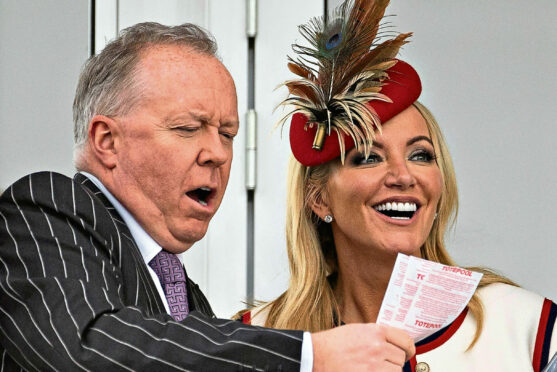

Glaswegian tycoons Mone, 51, a Conservative peer, and Barrowman, 57, are under investigation by the National Crime Agency (NCA) as concern surrounds the awarding of PPE contracts to a company linked to them.

PPE Medpro Ltd banked £203 million of taxpayers’ money for hospital gowns and masks in 2020 after Mone lobbied Conservative ministers for the new company to be put in the so-called “VIP lane” for preferred bidders.

She denied any connection to the firm. However, leaked paperwork suggests it later paid Barrowman £70 million, who then handed £29 million of it to a trust set up to benefit her and her children.

Coincidentally, the couple – who both deny any wrongdoing – subsequently enjoyed a spending spree including a luxurious honeymoon on the Maldives, a private jet, yacht and racehorse.

We told two weeks ago how companies linked to Barrowman’s Knox Group amassed a £10 million portfolio of assets on a single Glasgow street in the wake of the PPE Medpro deals.

Nine properties were purchased between December 2020 and August 2022 in Park Circus with more than £3 million spent in a single day in May 2021.

One townhouse has already been converted into luxurious flats while planning permission has been won to turn another into five apartments.

The government recently launched legal action to reclaim £122 million from PPE Medpro as the equipment it supplied was defective.

Mone is also being investigated by Westminster standards watchdogs over her alleged failure to declare the company in her register of interests. And she has stepped down from the House of Lords to clear her name over the claims.

That probe has been temporarily halted until police conclude inquiries. Meanwhile, the yacht – named Lady M – recently went up for sale as did a £20 million London townhouse where she lives.

Last year, NCA officers raided the couple’s home and Knox offices on the Isle of Man as part of a probe into PPE Medpro. Barrowman has also been charged with corporate tax evasion in Spain, where he could face jail if found guilty. MAL were approached for comment.

A spokesman for Mone said: “Baroness Mone has no involvement or financial interest in Harrogate Limited, MAL Holding Ltd or Monthly Advance Loans Ltd.”

A spokesman for Barrowman said: “Mr Barrowman is not a director or shareholder of Monthly Advance Loans Ltd.”

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe © Megan McEachern

© Megan McEachern