A NEW study has revealed that one in five Brits don’t have home insurance.

The research from Together Mutual Insurance reveals the vulnerability of the UK’s homes with 20% admitting they have no contents or buildings coverage.

The study also shows Scots consider themselves to have the most valuable home contents with the average dwelling containing £30,794 worth of belongings, followed by the East of the UK with £28,244 and London where homes play host to £28,214 of items.

The North East of England is the most uninsured region in the UK with 32% of homes in Newcastle going without buildings and contents insurance.

It has also been discovered that women are the worst offenders when it comes to leaving their home and its contents unprotected, with 47% bothering to get full home insurance, compared to 56% of men.

The cost of the risk in having no insurance goes beyond the one in five who have no home insurance in place.

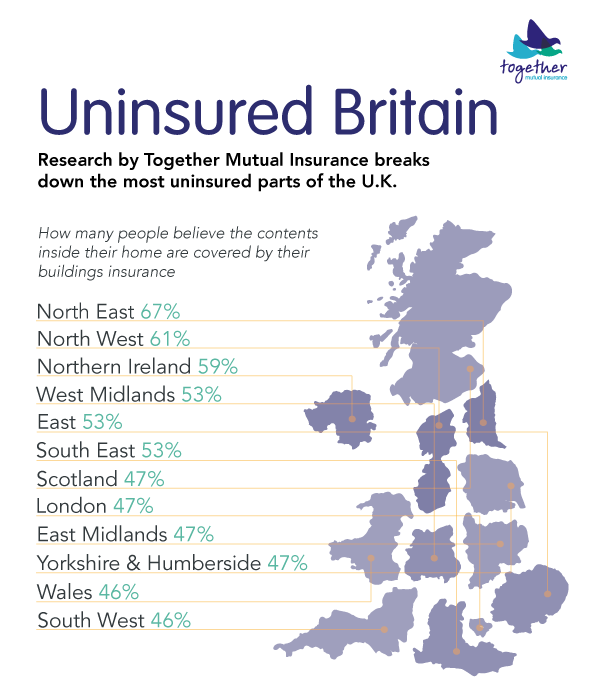

Of those with buildings insurance, 1 in 2 (51%) wrongly believe their contents is also covered, with the average UK household contents amounting to £25,857. A further one in ten respondents claiming to own over £60,000 worth of belongings.

Scots consider themselves to have the most valuable home contents with the average dwelling containing £30,794 worth of belongings, followed by the East of the UK with £28,244 and London where homes play host to £28,214 of items.

The most expensive items in UK homes are deemed to be kitchen appliances which amount to an average of £2,218 per home followed by jewellery (£1,760). Despite the high value of the belongings in UK homes, 19% of those who don’t have home insurance are people that have never even considered getting contents insurance while nearly one in ten (9%) believe their area is safe enough not to need any protection.

It may be surprising to find that women are the worst offenders when it comes to leaving their home and its contents unprotected with just 47% bothering to get full home insurance, compared to 56% of men.

Meanwhile, people in private rental accommodation are at risk with 42% of properties left uninsured followed by students with 31% of properties at risk.

When it comes to understanding policies, people in the North East are the most confused about what their insurance covers. 67% believe their buildings insurance covers their home contents and a whopping 41% in Newcastle believe their home insurance covers their personal belongings even when they are out and about.

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe