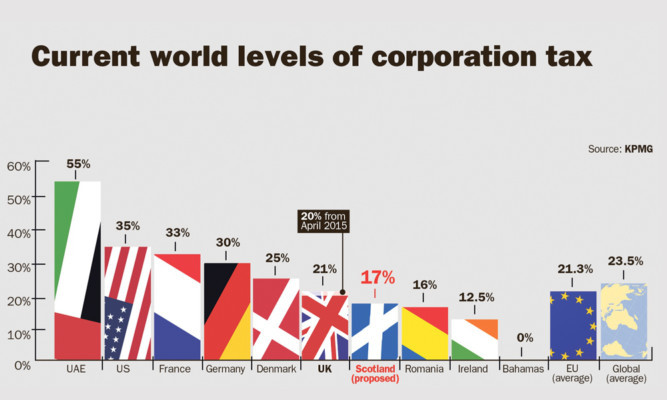

The SNP have pledged to reduce Scotland’s rate of corporation tax in the even of independence. Here, two experts discuss the pros and cons of that approach.

A reduction in Corporation Tax will make Scotland an even more attractive investment proposition

by David Cairns, Fellow of the Chartered Institute of Management Accountants and Chairman of PrismTech Group Ltd

A proposal to reduce Corporation Tax to boost the economy is on the cards with a Yes vote.

Would this be good for business and the economy or, as Ed Milliband claimed recently, would tax competition mean a race to the bottom?

There are advantages to a benign tax policy but focusing on the Corporation Tax rate alone isn’t the whole story. To encourage economic activity you are aiming to encourage investment and investment considers the totality of the proposition, all risks and rewards.

Even within the straightjacket of the UK tax regime, Scotland performs well in attracting overseas investment because the total package here is attractive. It could, of course, be much better and a cut in Corporation Tax will help make that happen.

So what about the Miliband warning?

Research published in 2013 Tax Competition and the Myth of the “Race to the Bottom” concluded emphatically tax competition simply does not lead to a ‘race to the bottom’. Sorry Mr Miliband. Overall competitiveness of countries drives different fiscal strategies and it is the overall attractiveness of the business climate that determines how successful each country will be in attracting capital flows.

Lowering the Scottish Corporation Tax rate will achieve little on its own, whatever the rUK rate, but independence offers us the ability to tailor a simpler tax code and a more targeted parcel of policies that can and should foster growth more effectively than the complex, one-size-fits-all, London-centric straight jacket of an outdated UK tax regime.

We should cut Corporation Tax as part of that package.

A cut would be a windfall for the rich

by Stephen Boyd, Assistant Secretary, STUC

The STUC does not accept that under any constitutional scenario a further corporation tax cut in Scotland will boost growth and jobs. The Scottish Government’s case is based on flawed and selective “evidence” and a misunderstanding of the Scottish economy and current business environment.

Scotland in 2014 is not Ireland in 1987. Even in Ireland, low corporation tax was but one factor contributing to rapid growth in the 1990s. Rather, the STUC is concerned further corporation tax cuts will exacerbate a long-standing structural problem in the Scottish economy the short-termist business culture which undermines long-term patient investment. Cutting corporation tax won’t increase capital investment or R&D.

Cuts confer no sustainable competitive advantage on Scottish firms as they’re so easily replicated and, as nations compete, more of the responsibility for funding Government spending will fall inevitably on workers currently experiencing an unprecedented collapse in real wages.

The benefits of a corporation tax cut may be imaginary but the costs will be real and immediate. It is hugely irresponsible to develop policy on the basis that a corporation tax cut will eventually pay for itself. Funding a 3p cut will cost around £400m. This money will no longer be available to help fund public services upon which we all rely. However a large slice will find its way into the pay and bonuses of corporate executives it’s a windfall for the rich.

Therefore, a corporation tax cut also works against the broadly-based prosperity the Scottish Government is seeking to achieve through its own economic strategy. By reinforcing the twin trends of falling wages and rising profits, a corporation tax cut would make Scotland more unequal and less economically resilient.

The Scottish Government would be more productively occupied developing a credible long-term industrial strategy for Scotland.

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe