The Scottish First Minister said the basic rate of tax would not rise at all under the SNP in the next Parliament.

She also announced that if the SNP win May’s Holyrood election there will be no increase next year in either the higher 40p rate or the additional rate of 45p paid by those earning £150,000 a year or more

But plans from Chancellor George Osborne to increase the threshold at which workers start paying the 40p rate from £43,000 to £45,000 in 2017-18, effectively a tax cut for the higher paid, will not be implemented in Scotland.

Instead the threshold will rise with inflation, to £43,387, meaning Scots earning this amount or more will pay more in tax than people on the same salary south of the border

She said: “By adopting a different path to the UK Government we could generate more than £1 billion of additional revenues, enabling us to protect the public services we all rely on.

“We believe that this proposal is reasonable. It is balanced and it is fair.”

If Scotland alone increased the top rate of taxation from 45p to 50p, it couldlose millions of pounds of revenue if a small proportion of these big earnersmoved their money out of the country, Ms Sturgeon said.

So she said while she wanted the 50p tax rate to be restored across the UK, the SNP have no plans to do this at Holyrood.

From April 2017 the Scottish Government gains control over income tax rates and bands, as part of the devolution of new powers in the Scotland Bill.

Ms Sturgeon announced if the SNP is returned to government, it would increase the threshold at which people start paying the levy over the five years of the next parliament to £12,750 – marginally higher than the UK’s proposed starting point for income tax of £12,500 by 2020-21.

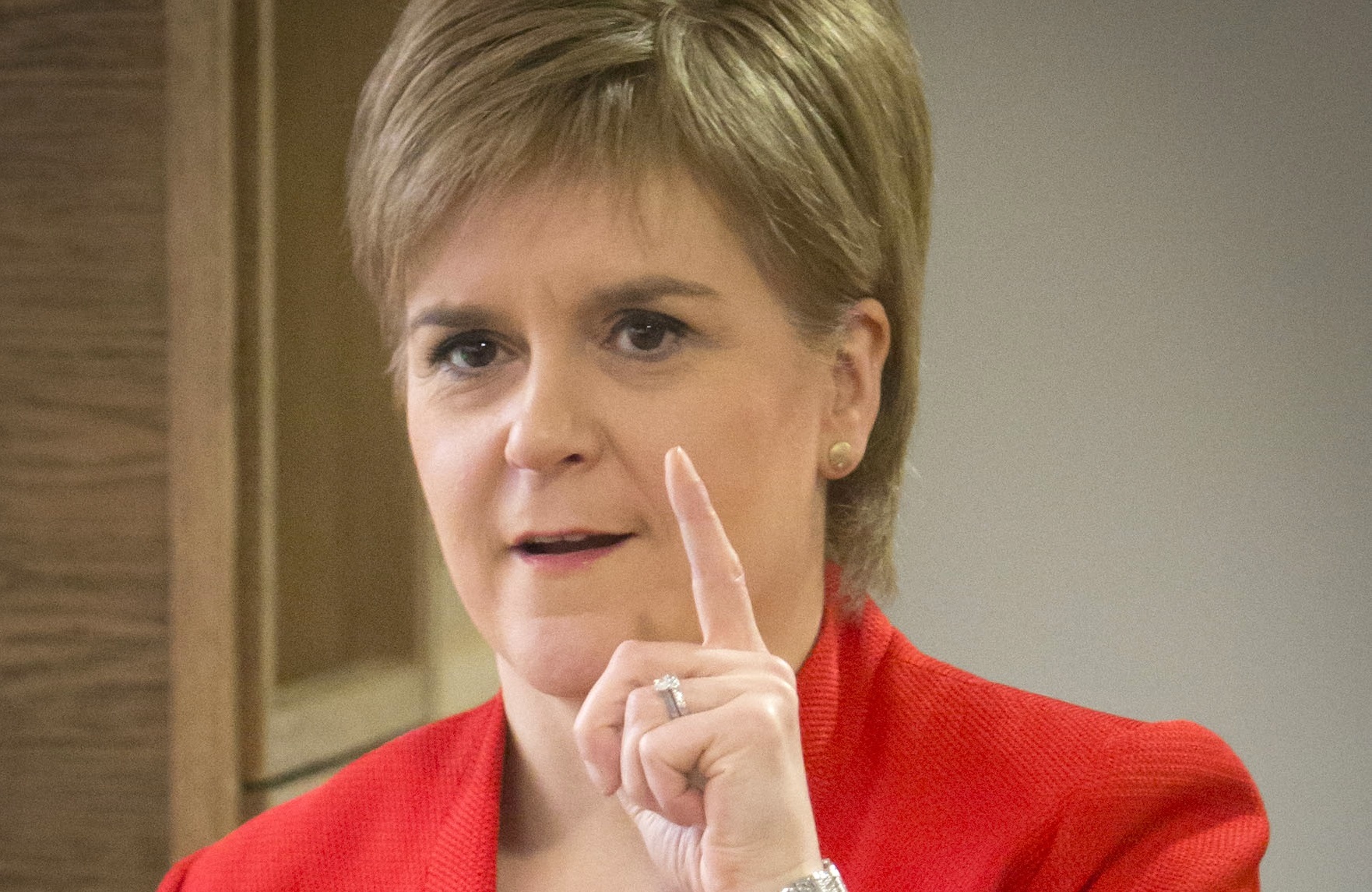

The First Minister unveiled her party’s tax plans on a visit to the Royal Hospital for Children in Glasgow – part of the £842 million new hospital development on the south side of the city.

Ms Sturgeon added: “It is a determination to protect and enhance our public services that is one of the key factors driving the proposals on income tax we are setting out.

“In setting out our proposals we have balanced the need to invest in and support our public services with a recognition that many households are still struggling to make ends meet and also with the need to grow our economy.

“The proposals I am announcing today strike that balance. They are fair, progressive and balanced.

“They will enable us to protect and increase the revenue that our public services and our economy rely on and they will ensure Scotland is and is seen to be an attractive place to work and do business.”

She argued the UK Government had made “fundamentally the wrong choice” by cutting tax bills for higher earners at the same time as it continues its programme of economic austerity.

“We will not allow our public services to pay the price of an inflation busting tax cut for the highest earning 10% of the population,” she stated.

“We will take a different approach.”

While both Scottish Labour and the Liberal Democrats have called for an immediate 1p increase in the basic rate of income tax in Scotland, to raise almost £500 million tor cash-strapped services, Ms Sturgeon argued: “We don’t believe it’s right that those on low and middle incomes are asked to pay for Tory austerity, that doesn’t tackle austerity, it simply shifts the burden to those who can least afford it.

“That’s why I’m guaranteeing we will not increase the basic rate of tax in 2017-18 or in any other year of the next parliament.”

She continue: “It’s not our intention to increase the higher 40p rate either, however we will not cut taxes for higher rate tax payers. We will not increase the higher rate threshold to £45,000 in 2017-18 as the Tories plan to do, nor will we increase it to £50,000 by 2020-21.

“Instead in 2017-18 we would freeze the higher rate threshold, it will increase only in line with inflation.

“We will take decisions for future years in our annual budgets, but I can confirm today that the maximum increase we will apply to the higher threshold will be inflation.”

The First Minister said: “It’s important to stress higher rate taxpayers willnot pay a single penny more in tax than they do just now as a result of ourplans.”

But she added the “decision not to pass on an above inflation tax cut” would allow the Scottish Government to generate an estimated £1.2 billion of additional revenue over the next parliament

“That will allow us to better protect the public services we all rely on, including our National Health Service and to mitigate Tory austerity,” she stated, arguing she believed the proposals would be “widely supported”

Ms Sturgeon said higher and additional rate tax payers in Scotland will “pay a bit more in tax than their counterparts in England”, saying this would amount to an extra £323 in 2017-18.

On the decision not to increase the top rate of income tax in Scotland, she said analysis “indicates to increase the top rate of tax in Scotland alone while the UK rate remains unchanged would risk millions of pounds of revenues a year”.

She said: “If just 6% of top rate tax payers chose to relocate their income out of Scotland the Scottish Government would raise no extra revenue from to 50p in the top rate.

“If 7% were to do so we could lose £30 million in revenues.

“Given the need for stable and predictable revenues in the next parliament , given the responsibility we have to public services, that is a risk that in my judgement it would be irresponsible to take.”

But she said experts in the Scottish Government’s Council of Economic Advisers would consider this situation each year.

While the highest earners in Scotland will pay £323 more in tax in 2017-18, MsSturgeon accepted that could rise to a total of £817 more by the time of thenext Westminster election.

But she insisted: “If you are a taxpayer in Scotland you get better value for your taxpayer pound.”

Ms Sturgeon said: “Asking people to forgo a tax cut and to possibly contemplate not increasing the higher rate threshold in line with inflation some years is asking people to play their part in meeting the financial challenges we face.”

She stressed that politicians must not consider a desire to be radical when determining tax policy, but should instead look at how to “properly steward the finances of the country”.

The First Minister stated: “Tax policy is not a political plaything for politicians, it is not what we do to make grand political statements. It’s about how we raise the revenues for our public services, it’s about how we make sure we can grow our economy, it’s about how we can make sure Scotland is seen as an attractive place to do business.”

READ MORE

First Minister Nicola Sturgeon expresses horror at ‘devastating’ Brussels attack

Budget 2016 RECAP: Look back on reaction to George Osborne’s speech

Enjoy the convenience of having The Sunday Post delivered as a digital ePaper straight to your smartphone, tablet or computer.

Subscribe for only £5.49 a month and enjoy all the benefits of the printed paper as a digital replica.

Subscribe